The average cost to build a house is 248000 or between 100 to 155 per square foot depending on your location size of the home and if modern or custom designs are used. Now keep in mind that that cost must cover everything including.

How Much House Can I Get With 100k Income Youtube

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000.

. But this persons credit score is 700 and they only pay 250 in non-mortgage debts each month. As a rule of thumb a person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000. Thats because annual salary isnt the only variable that.

Using a home loan of 300000 this would be the results based on a fixed rate of 4241 APR. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford. House Affordability Calculator There are two House Affordability Calculators that can be used to estimate an affordable purchase amount for a house based on either household income-to-debt estimates or fixed monthly budgets.

Buying a house with a 100K salary and good credit Our second borrower also makes 100k a year. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. Make sure to consider property taxes home insurance and your other debt payments.

With a salary of 200K per year how much. New home construction for a 2000 square foot home runs 201000 to 310000 on average. They are mainly intended for.

Martin can easily afford this place while it is a bit harder for Teresa. 0 down for veterans and their spouses no mortgage insurance required. The 28 percent rule is the most often used guideline for determining whether or not you can purchase a property while there are others.

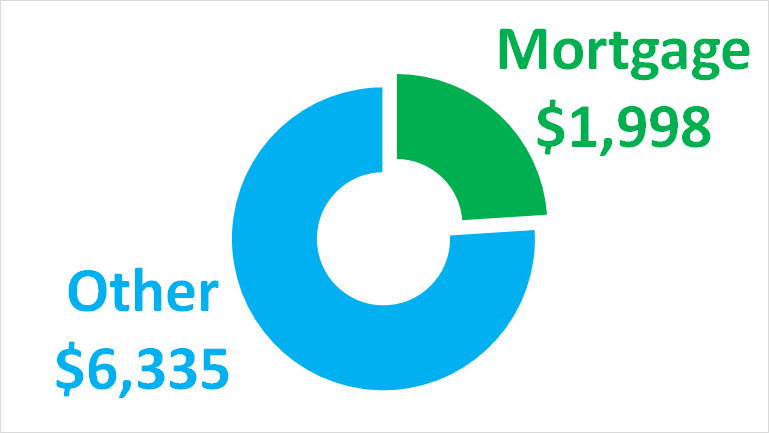

A 500 car payment can reduce your buying power by. This is what you can afford in 449484 Your monthly payment 2500 Affordable Stretch Aggressive Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax income would go toward. For example if you earned 100000 a year it would be no more than 2333 a month.

With four bedrooms and three baths this 3000-square-foot home costs 300000. Add in the 500 student loan payments shes making each month. If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo.

If you make 100000 a year you may purchase a house at 558845 not counting taxes and insurance. Use this calculator to calculate how expensive of a home you can afford if you have 110k in annual income. You want to keep your debt payments as low as possible.

What is the monthly payment of the mortgage loan. Use our home affordability calculator with amortization schedule below to receive a more accurate estimate. How much house can I afford if I make 200K per year.

What Can I Do To Lower My Mortgage Payments. The most common rule for deciding if you can afford a home is the 28 percent one though many are out there. Assuming she makes a down payment of 27300 or just under 10 her monthly housing payments will be 2110.

So who can afford this house. Estimate home price range Get pre-approved Confirm your affordability with multiple lenders Get. The monthly payment of 1267 is equal to 456017 over the course of 30 years if the interest rate is 45 percent and the period is 30 years respectively.

Equally the lower the interest rate you can get the less youll pay each month against your mortgage as well as over the life of the loan. If youre wondering how much house you can buy on a 100000 salary the 25 rule will offer you a mortgage of 250000 according to the 25 rule. Even for people on a salary of 100000 that may not be the case.

You should buy a property that wont take anything more than 28 percent of your gross monthly income. BUT and this is a big but this number assumes you have very little debt and 112000 in the bank. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000.

What salary do you need to buy a 400k house. What does this mean. Most home loans require a down payment of at least 3.

If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000. How much house you can afford on 100k also depends on how much debt you currently have including auto loans student loans credit cards and other loans. Using a 45 percent interest rate and a 30-year term this translates into 1267 monthly which equals 456017 over 30 years.

How Much Of A Mortgage Can I Afford Making 150 000 A Year

I Make 100 000 A Year How Much House Can I Afford Bundle

100k Salary How Much House Can I Afford Mintco Financial

Can You Build A Home For Less Than 100k My Alternative House

10 Cool Houses Under 100 000 Budget Friendly Housing Options

How Much House Can You Afford On A 100k Salary Youtube

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

What Kind Of Home Can You Buy For 100 000 Usd In Your Area Quora

0 comments

Post a Comment